There’s a growing cult of poor people praying for Universal Basic Income — free monthly cash, no work required. While they wait for the government to hand them a miracle, you can sell them hope wrapped in affiliate links. Build fake ‘UBI checkers.’ Dangle passive income. Push shady CPA offers. They’ll click anything that smells like free money. This guide shows you how to farm the desperate before UBI even becomes real.

Side Hustle Trends and Ideas

Side hustles you have never heard of before

Cashing in on Polymarket’s Parlay Play

Don’t just bet on Polymarket — create the markets, hype both sides, and get paid every time people fight over the outcome.

Prediction markets are exploding, and Polymarket is leading the charge. Most people see it as a place to gamble. Smart hustlers see it as a place to manufacture markets and monetize the flow.

The best part? Polymarket literally pays you to create popular markets. And once those markets exist, you can make money from both sides of the bet.

Here’s how:

💡 Step 1: Become a Market Architect

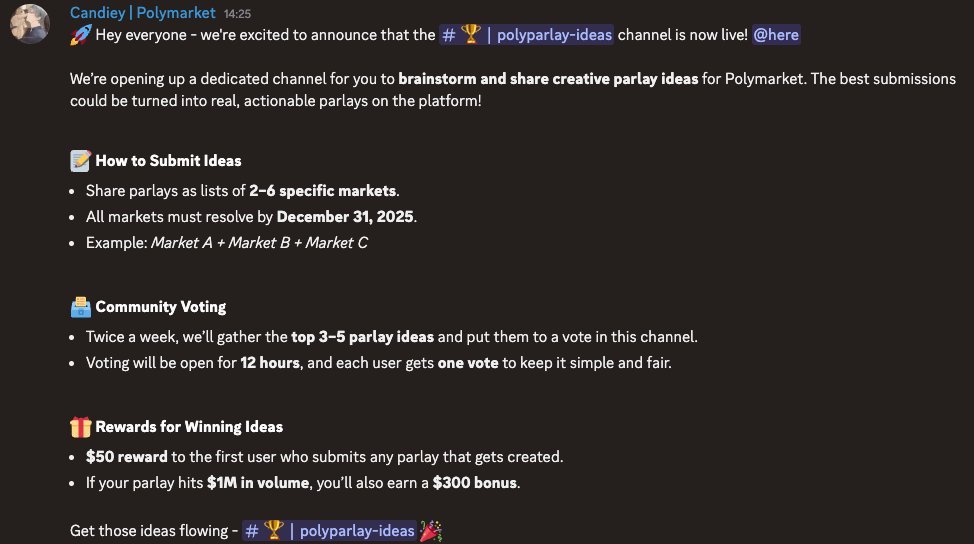

- Join the official Polymarket Discord.

- Pitch parlay markets (combined outcomes — think “Trump wins + ETH > $4K”).

- If selected → you earn $50 upfront.

- If your market crosses $1M in volume → $300 bonus.

- Dark Play: Don’t just rely on luck. Pick polarizing, high-traffic topics (politics, sports, celebrity scandals). Build around where the crowd is most addicted.

💡 Step 2: Monetize the Bettors (Retail Side)

- Create content funnels (Twitter threads, TikToks, Discord rooms) hyping “your” markets.

- Frame it as: “Here’s the bet the smart money is taking.”

- Use affiliate links or cloak funnels to drive more users into your markets → more volume → more bonuses for you.

- Bonus Trick: Offer private “betting groups” for “inside strategies” at $10–$50/month subscription.

💡 Step 3: Monetize the Whales (Supply Side)

- Offer white-label research services for funders or syndicates who want predictive edge.

- Sell “heat maps” of where traffic is flowing in Polymarket.

- Charge retainers: $500–$2,500/month for data insights or “signal dashboards.”

💡 Step 4: Play the Token Angle

- Imagine Polymarket integrates tokens for market creation. You’ll want to be early here.

- Create a micro-token that mirrors this model → “burn token to create bet, earn token back on volume.”

- Pitch it to small DeFi communities as the “next Polymarket clone.”

- Sell early positions in your clone or simply flip the token narrative.

💡 Step 5: Layer the Arbitrage

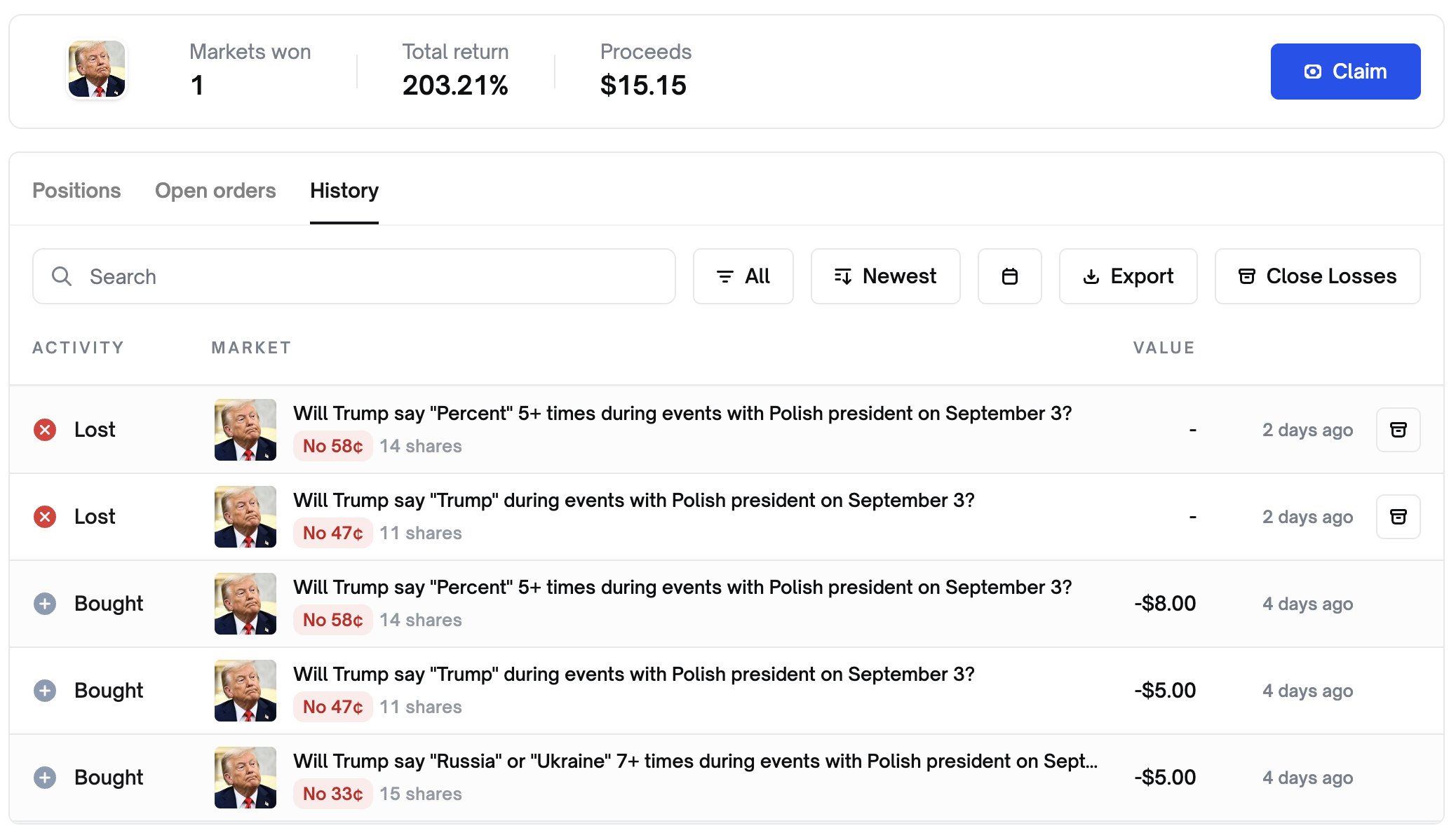

- You can hedge both ends of your own market.

- Example: create a high-traffic “ETH > $4K by end of year” market. Buy positions on both Yes and No early when liquidity is thin. As traffic flows in and odds skew, you resell into hype, skimming spread like a bookie.

🚀 Closing Thought

Polymarket is not just betting. It’s a content machine, a volume farm, and an arbitrage engine if you see it from both sides. You create the market, hype it up, collect the volume bonuses, and still skim spread by playing both ends.

It’s the dark side of market making: you’re not betting on outcomes, you’re betting on human attention — and that’s always predictable.

Similar listings in category

Monetize financial desperation by arbitraging the "give car back" trend, profiting from both voluntary repossessions and subprime refinancing leads.

Airdrop farming is the modern-day gold rush, turning early engagement and small tasks into significant crypto payouts.